We got a lot of great feedback and many new subscribers on our debut deep dive on Olympus DAO. We’re happy to have you all here, and very excited to start putting out more of what we hope you’ll see as quality content.

The first of which will be this newsletter series we’re calling Alpha Watch, where we share what’s on our radar each week. Our plan is to outline major themes as well as small cap gems we’re watching. This series will be in addition to our longer form deep dives on projects. We hope you enjoy!

Is NEAR the Next L1 Rotation?

2021 was the year of the alt-L1 rotations, we saw Solana, Fantom, Avalanche, Luna, and others all bring tremendous returns to those who timed their rotations properly. So of course the answer to the question everyone’s dying to know is which L1 is next?

As of now, there are signs indicating $NEAR could be it.

Near Protocol is a Proof of Stake blockchain that utilizes sharding to scale. This is essentially what the Ethereum Foundation is promising ETH V2 will be, except with Near it’s already here.

Near also operates a unique L2 smart contract platform called Aurora, which currently offers zero, yes ZERO, fee transactions. Aurora is where the majority of Dapps on Near currently reside. Aurora is an EVM which means you can seamlessly bridge to it from Ethereum. You can try it yourself using their Rainbow Bridge here, simply add the Aurora RPC and bridge over from the Ethereum Mainnet.

Let’s take a look at some metrics that portray the bull case for Near in the coming months.

NEAR Price Action

Near has had a remarkable run since July of this year, running 8x since its all-time lows and 2x this week alone.

Today (December 27th) Near is putting in its first red candle on the daily over the past 7 days.

This type of pullback is nothing to be alarmed about, as we still have bullish market structure on all high time frames. One area of concern is the bearish divergence on the RSI forming on the weekly. It’s a relatively weak trend, but something to watch as Near continues on its upward trend over the coming months.

On the weekly, if Near holds its’ trendline at around $14.5, then we should see a visit to the $17-$20 range.

If we are to see a deep pullback scenario, anywhere in the $8.5 -$11.75 range would be a good place to start DCAing in.

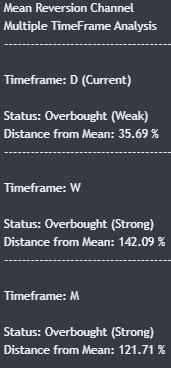

A tool we like to use to validate our technical levels is the Mean Reversion Channel indicator.

As we can see, the weekly and monthly are showing that Near is strongly overbought, while the Daily is slightly overbought.

The Mean Reversion Indicator is available on Tradingview, and is a great tool for you to get a sense of where key algorithmic levels are for entries. Given that Near has been one of the top performers across the entire market, a pullback to approximately $9.5-$10 would be healthy and nothing to raise concern.

If the macro environment and BTC can turn around, we should see Near continue on its exponential run over the coming year.

In addition to price action let’s compare market caps of each of the top alt-L1s as of this writing:

Solana: $62B

Luna: $37B

Polkadot: $33B

Avalanche: $28B

Near: $8.3B

With room to run, Near could be a clear out-performer in Q1 2022.

Near Ecosystem & TVL

With one week still left to go, Aurora TVL has grown nearly 500% in December.

The top three Dapps on Aurora are currently are Trisolaris ($TRI), WannaSwap ($WANNA), and NearPad ($PAD). The first two are both DEXs that offer cheap swaps on Aurora, and NearPad is both a DEX and IDO launchpad platform.

Our Watchlist

With the ecosystem in early bloom, these are the projects we’re watching closely that may have tremendous upside if Near Protocol takes off.

NearPad.io ($PAD)

NearPad is an IDO launchpad platform similar to that of $XAVA on Avalanche. There are a few reasons to be bullish on PAD over the coming months. The first being that in order to participate in IDOs users must purchase and stake a minimum of 1,000 PAD for at least 21 days.

This creates strong buy pressure for those who are looking to get access to IDO allocations which often see astronomical 10-100x returns post launch. In addition to the buy pressure, by requiring users to stake and maintain a certain balance it reduces sell pressure over time as well.

We like PAD because the token itself has room to run, but even if it doesn’t you have the massive upside from receiving IDO allocation.

Necc.io ($NECC)

Necc is one of the more interesting plays on Near. It’s currently sitting at around a $6M market cap and is one of the more degen/high risk-reward plays in the ecosystem.

Necc is a decentralized, fully collateralized stablecoin protocol that utilizes delta neutral positions to create the backing. Simply put, they open equal sized long and short positions as to not have a directional market bias, and these positions act as the backing for the stablecoin.

Necc has launched an inverse perpetual swap DEX that allows users to trade up to 30x leverage. The stable coin is NDOL, and the fees accrued from the DEX go to NECC holders.

To add in another twist, NECC is following the Olympus model of Protocol Owned Liquidity by offering bond discounts to those who exchange NDOL-nNECC LP tokens. This will also generate more fees that will go back to NECC holders. You can read more about all of the various mechanics of Necc here.

This is a highly speculative play, but the market cap being as small as it currently is, Necc could be worth a punt.

Rose.fi ($ROSE)

Rose was the first project launched on NearPad, and they are attempting to act as the liquidity layer for Near. They are taking the Abracadabra.money approach by launching RUSD & ROSE equivalent to MIM & SPELL.

Users can mint the RUSD stablecoin by staking ROSE, receiving the interest bearing token stROSE, then depositing stROSE in exchange for RUSD. Again, mimicking the MIM, SPELL, sSPELL model.

Rose has also announced their first partnership with Frax, who operates one of the most successful algorithmic stablecoins across multiple chains. They are launching a RUSD-FRAX pool, and are planning to allow users to deposit Frax Shares (FXS) as collateral for RUSD as well.

As Rose continues to expand its partnerships and grow with the Near ecosystem, they could be well positioned to see early SPELL like token performance in Q1.

Conclusion

Near is quickly gaining narrative momentum as well as seeing rapid capital inflows from investors looking to get in early on what could potentially be the next big ecosystem play.

We’ll be monitoring user & TVL growth going into the new year, and keeping our eyes peeled for hidden small cap gems as they begin to pop up.

Thanks for reading, see you next week :)

Disclaimer: Defi Mafia and its contributors are not financial advisors and nothing you read should be considered financial advice. We often invest in many of the tokens, projects, and protocols we discuss. This both gives us skin in the game, but has potential to alter our bias, always keep this in mind when reading.