An Overview of the DeFi Landscape: 2021 in Review

2021 in many ways was the year of a decade’s worth of dreams coming true. Total crypto market cap not only crossed the psychological $1 Trillion threshold, it skyrocketed to a peak of over $3 Trillion.

In 2021 institutions and broader society as a whole began taking crypto much more seriously. In the years moving forward it’s clear crypto will no longer be ignored. In fact quite the opposite, in many ways the 2020’s look to be the decade of crypto.

As we prepare to make the leap to the mainstream, let’s review the dizzying amount narratives, innovations, people, and memes that defined 2021.

1. The Rise of Alternative L1s

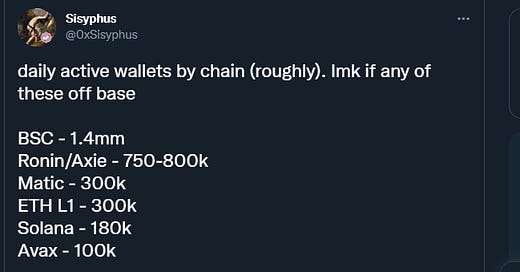

Without a doubt the biggest thing that went on in 2021 was the parabolic rise of alternative Layer one chains. We saw what Ethereum was capable of with DeFi summer in 2020, but Binance Smart Chain circa spring 2021 showed us there's demand for a cheaper, faster, and more retail friendly chain. It’s funny that Binance Smart Chain is so absent from (English-speaking) Twitter discussion, because it actually has over 4x the number of active users compared to ETH mainnet.

Whether you like it or not, there is a need for a cheaper and faster alternative for retail to participate in on chain activity.

Ethereum basically says if you don’t have a mid five figure stack, you can’t play here. So naturally places like Binance Smart chain, Solana, Avalanche, Fantom, and even more low-traffic L1s are seeing growth due to the low barrier to entry.

We saw this come to fruition back in March with the explosion of BSC and Pancake Swap. In peak “dog mania” prior to the May correction, BSC and Pancake were “all the rage”, ranging from degen shit coiners to your humble farmers following capital flows. Shortly after, the Polygon network caught a lot of adoption as well. You can see the peak of their TVL on-chain here.

2. Liquidity Incentive Programs

Following the correction in May, on-chain activity stagnated for these aforementioned chains. However, fast forward to the end of the summer / early fall is when things really started to heat up. This is when the infamous “L1 rotation” started to pop off in a big way.

Solana kicked off this Layer one wave back in August. A big reason for this was the different incentive programs these chains announced. Polygon had done this prior, but it was the $700M Avalanche Rush program that kicked things off in a big way for the fall.

Fantom quickly followed suit with their ecosystem growing exponentially right before the start of their liquidity mining program.

Notice a trend here? These liquidity mining incentives were a great way to bootstrap an ecosystem.

However, the question still remains:

“What happens when these incentives and yields dry up?”

Will the liquidity locusts of the world migrate to the next hot L1, taking their money wherever they can rent it out for the highest yield? Almost certainly.

So how much of the community and die hard Avax chads or “Lunatics” will stay, despite potentially losing out on better yield? The question remains to be answered.

Not everyone wants to have three different browser extension wallets and 10 different EVM RPC’s, and it’s certainly not friendly to normal retail folk. Just the act of bridging is incredibly daunting to newcomers with little to no on-chain activity. That being said, this is yet another variable that proves we’re early to this whole wave.

It’s worth noting that Coinbase enabling withdrawals directly to chains has proven to be a massive catalyst thus far.

Earlier this year, Coinbase enabled withdrawals directly to the C-Chain. This accelerated on-chain activity in a big way. The TVL growth as a result speaks for itself.

Solana is another example of this.

It wasn't until July when Coinbase added it to their exchange where we saw the SOL ecosystem start to see exponential growth. Similar to Avalanche, the ability for one to withdraw SOL directly to their Phantom wallet was a major driver behind TVL growth.

3. Non EVMs

Solana and Luna showed that non-EVM chains can capture a piece of the pie too. The Phantom Wallet for Solana was a non-trivial variable for network adoption. In its current state, Metamask has proven to be a huge barrier to entry for most. It’s unreasonable to expect millions of non-native crypto people to:

Set up multiple RPCs and bridge to multiple chains

Rely on poor security

Use a sub-par UI/UX

It’s not clean, and has had constant issues with Ledger throughout the year. We need a better wallet as a crypto industry that is universally adopted to gain more serious network adoption. People like to have their things in one, convenient place.

Like protocols, we don’t want to fragment our liquidity all over. Reputable developers such as Andrej Condej from Yearn & Fantom and Stuart Popejoy from Kadena have discussed their qualms with EVMs and the Solidity language. One could argue that the ungodly amount of money that’s been hacked from smart contract bugs on Solidity is strong enough evidence that supports this viewpoint.

Some of these non-EVM chains will be more difficult to hack as the blockchain industry develops, but in the current state, protocol security remains a huge issue.

Most recently, two white hackers found a vulnerability in the Polygon network that would have enabled over $24B to be stolen. In order for the industry to move toward mainstream adoption, these types of security issues must be resolved as more users and capital flow into the system.

There are relatively new protocols emerging that aim to solve this issue.

Projects like Kadena have designed their own programming language called PACT which is designed to auto check for smart contract bugs from the ground up. This creates both a better developer experience and a higher likelihood of more mainstream players trusting these systems.

4. Capital Rotations

By looking at the above TVLs, it’s clear that there is a constant flow of capital moving from different L1s.

A lot of this is catalyst driven via incentive programs. Some of this is certainly narrative driven. We went from “Sam [Sam Bankman-Fried, CEO of FTX exchange] Season” and “Solana Summer'' to every other chad on the timeline having a red triangle next to their name.

As an active market participant, it’s vital to understand the attention economy of crypto and how finding new narratives can be extremely profitable.

If 2021 has taught us anything, it’s:

Don’t fade the narrative.

Joe Lubin from Consensys and many other respected blockchain figures have publicly stated the future is multichain. We don’t need 20 slightly different EVM’s, we need a cohesive system that works in complete unison.

The L1s that will see see the most long term success are:

The most fundamentally sound

Have the strongest teams

Have good communities

Are actually innovating and creating unique use cases for blockchain centered around multichain

Sol, Luna, Avax, Matic, and FTM are currently the strongest L1s. The teams building out infrastructure early will have a better shot at solidifying themselves in the future. This is a fast paced environment, and the teams that prove they can deliver on time and ship quickly are clearly at an advantage.

Taiki Maeda: mastering the capital rotation game

Taiki is a perfect example of someone who has publicly played the capital rotation and narrative game.

He was farming on Polygon back in May. He then rotated into the Luna ecosystem using protocols like Anchor and Mirror. Finally, he entered the Avalanche ecosystem at $10 where he began farming coins like $JOE in August.

Taiki’s Youtube channel has become one of the top DeFi education and alpha channels in the space. By publicly sharing his capital rotation plays, Taiki has solidified himsefl as one of the most important and influential thought leaders for smart money flows across the entire DeFi and crypto Twitter landscape.

As Hard Rock Nick said it best:

Taiki has solidified himself as one of the most important thought leader for smart money flows to consider as an active DeFi participant. Be sure to subscribe to his channel here if you don’t already.

5. The Rise of Dani Coins

We can’t discuss crypto or DeFi in 2021 without talking about Daniele Sestagalli; better known as Dani or Daniele Sesta.

Many know him as the King of Frog Nation and founder of multiple powerhouse DeFi platforms such as Abracadabra Money, Time Wonderland, and Popsicle Finance. However, his vision for democratized finance began in 2018.

Prior to his current endeavours he had founded Zulu Republic, whos stated mission was to create:

“An ecosystem of digital platforms built on the Ethereum blockchain, founded on and motivated by the idea that decentralized collaboration is the human protocol of the future.”

He has since taken this core thesis and created a new reality for all DeFi users across multiple chains. Within a short time frame, Dani has transformed from a lesser known developer to one of the most prominent figures in the DeFi landscape.

Dani’s fame can be attributed to a few different factors:

Well built, practical solutions (ex: abracadabra bridge) - Advancing the growth of DeFi

Being Blockchain agnostic - Not being a one chain maxi, helping bridge liquidity to a variety of chains, and expanding to non EVM’s (Solana and Luna have been announced thus far)

Strong leadership - Dani is a sharp, outspoken, hard worker, and ultimately appears to be a genuine person who wants to support and create as much value for his community as possible.

Community - We can’t discuss Dani without talking about the #FrogNation, or the various #PeopleMaxi / #OccupyDeFi hashtags that he has spearheaded. He has put on a clinic for how to bootstrap a community.

His genuine personality, interviews, and public Twitter Space appearances have showcased to the world who he is as a person. This has helped him tremendously grow his following base and help the overall growth of his projects.

The #Frognation is one of the strongest communities in crypto. Community is one of the most important vehicles that drives price appreciation. Prime examples of this are Cardano and Doge coin being in the top 10 market caps. There are much stronger projects, yet they still command over $90B between the two. It goes to show that fundamentals aren’t everything and that community holds a tremendous amount of value; an area Dani has mastered.

Prior and future claims to fame

There have been other figures like Dani in the past. Andre Cronje from Yearn was known as the “king of DeFi '' prior.

That torch has been passed down to Dani in the eyes of the public. That might change in the future, but Dani is doing a great job remaining king at the moment. It’s worth mentioning how crazy the market went over “Dani Coins” back in the fall. ‘Sam coins’ were the leading narrative in mid 2021, which shifted to Dani Season not long after. While the hype only lasted a few months, the price action on his ecosystem coins showed how strong the narrative around him was.

Lastly, it’s worth mentioning how $Sushi was on a long downturn since the beginning of February, dipping 80% since its all time highs.

They had a weak community, and a multitude of issues internally with their team. Once Dani stepped in and integrated Sushi into his ecosystem, the overall market sentiment shifted almost instantaneously.

6. OHM Forks

We can’t talk about DeFi in 2021 without getting into Olympus DAO and its various forks. OHM is trying to become the decentralized reserve currency of crypto. If you need a refresher, one of our team members @d_gilz did an in-depth coverage of Olympus DAO last week.

Olympus kickstarted the “protocol owned liquidity” style of project that we saw get forked over and over again. It’s actually a fascinating concept, the idea of protocol owned liquidity and how that is a new dynamic for DeFi protocols.

Olympus has even taken it a step further by effectively becoming a “decentralized VC” for different DeFi projects. The assets in the Olympus treasury can be thought of as their various ventures. Under the same vein, we recently saw Sifu (the Wonderland / TIME treasury manager) sell AVAX back in November, and then add Ethereum and Convex to their treasury.

Good Forks

Now if you know $OHM, you probably know $TIME too. Another Dani play, however this one with a much different spin.

Wonderland taking a “gaming/music/nft” direction, versus Olympus sticking to a more “DeFi focused” sort of vision. We recently saw some beef between the project teams (Dani and @ohmzeus), which left a bitter taste between the communities.

$TIME is the strongest $OHM fork, and recently flipped Olympus in market cap. OHM has a more concrete roadmap and goals in mind, while Wonderland has an ambitious vision with less clear steps on how they will achieve it.

However, Dani has stated they’ve already started working with Live Nation and another undisclosed festival promoter. His goal with this is to expand the awareness, community, and ultimately capital that Wonderland commands.

Through a slew of nonsense ponzi clones, there have been a few legitimate forks pop up. KlimaDAO on Polygon is a carbon credits based protocol that has bootstrapped a treasury equivalent to 13,789,320 TONNES of CO2.

While the longevity of these sorts of projects are still in question, the main point to takeaway is even in a sea of rug pulls and scams, there are still legitimate teams, projects, and use cases.

The last one I’ll mention is $BTRFLY or Redacted Cartel. This is a Curve/Convex focused “OHM Spoon” which is backed by the one and only @Tetranode, another infamous DeFi figure. You can see his initial tweet about it here.

You don’t fade Tetranode, another lesson from 2021. If he’s backing a project, it's probably worth your time looking into it. Also, the head Dev at DOPEX (@tztokchad) is an advisor to Redacted Cartel as well.

You can view this project as a new version of a hedge fund that’s going to be a big part in the Curve wars going forward. If you don’t know about $CRV wars, you can check out a short read about it here.

Bad Forks

99% of OHM forks are complete scams. They often rise in price extremely fast, and crash quickly followed by a slow bleed out.

One common problem with all these forks besides contract vulnerability and rug pulls is that they do not know how to properly regulate their bonding.

Oftentimes, bonds will be in the negative %’s, which has a ripple effect on the price. There is also a common misconception that the price cannot fall below the treasury backing.

Another practice people have used is exploiting the rebase periods. This happens in 3 steps.

Buying in prior to rebase

Getting a sizable rebase

Dumping right after

You can see this pattern routinely played out in charts, even with larger ones like $TIME. So keep in mind that although the returns can be massive, the risk on these types of plays are extremely high.

7. Rise of Native Chain DEX’s:

An interesting thing to take note of throughout the year is the popularity of each blockchains native DEXs.

Pancake Swap was a clear example of this back in the spring. At one point their volume surpassed Uniswap’s for a brief period of time. There was also a certain time period where Sushi was poised to be one of the most well positioned Dapps to gain traction in a multi chain world. However, we did not see that come to fruition. Pancake was only foreshadowing for what was yet to come.

8. The Fall of Sushi

As you can see here, Trader Joe is clocking in at over 2 billion dollars in TVL, firmly ahead of the rest of the competition. One interesting observation is that it wasn’t just Sushi that took a hit here.

Pangolin was the original DEX on Avalanche. Back in August, $PNG was a huge AVAX ecosystem play that watched $JOE surpass them to become the chain's top DEX. Trader Joe saw a great deal of success due to their marketing, branding, and meme-ability. Memes are an underrated and extremely important of crypto content strategies, and a big reason why Joe was able to gain the top spot so quickly.

It’s not just Avalanche this is happening on by the way. Check out the TVL’s on the Fantom ecosystem!

Sushiswap is currently fourth in TVL after the three native Fantom Dex’s.

Multichain benefits? Or fragmenting liquidity across too many chains?

The market clearly decided for us before Dani came and saved the day. I do think Sushi had good intentions trying to deploy on each EVM, but that strategy has not played out well in hindsight.

9. Play to Earn

The rise of Playfi or Play to Earn throughout 2021 is obvious with projects like Mana, Sand, and PYR seeing huge gains over multi-month time spans. This all got kicked off with Axie Infinity taking the crypto world by storm.

Axie blew up in Southeast Asia, specifically the Philippines, where people could play the game and earn many multiples of what they would have otherwise earned in a normal job.

It’s absolutely amazing that a game like this could meaningfully improve people's lives. Not only is that exciting from a humanitarian perspective, but it also will enable different ways for people to spend their time or even find employment worldwide.

Axie already competes with some of the top Web 2.0 gaming conglomerates in total market cap, showcasing that strong game-fi projects can see major success in a hyper competitive market sector.

And of course now we have Defi Kingdoms, a “world of warcraft x Runescape” style game on Harmony. DFK recently passed Axie in volume on the 24hr, 1 week, and 1 month time frames.

Some other interesting features that makes DFK have a promising outlook are:

High yields coming from the various LP’s in the garden

Top tier UI/UX (with an even better soundtrack)

Cross-chain compatibility bridging over to AVAX in Q1 of 2022

Created its own in game economy

A massive Twitter narrative including personalities like @Ansem and @Satsdart

DFK Guilds forming that act as teams or clans for the PvP game

This is all while building on Harmony that currently has a relatively undeveloped ecosystem. DeFi Kingdoms will soon be on FTM, with plans to add other major L1 protocols in the future. You can check out the DFK roadmap here.

10. Layer 2 speculation and infrastructure

Lately there's been a lot of discussion regarding Layer 2’s. There are different types of layer twos. Optimistic and ZK (zero knowledge) are the main ones at our disposal right now.

A lot of people seem to doubt layer twos as if they're nonexistent or something far away in the distant future. However, I’d argue that L2s will be a major narrative and play heading into the first half of 2022.

Arbitrum is already fully up, and has some unique protocols such as:

1. GMX

2. DOPEX

DOPEX is an options protocol supported by the aforementioned Tetranode and the legendary @DeFiGod1

Optimism is also up and running more recently. The dapp development appears to be a bit more selective there (Synthetix, PERP, and Uniswap are there already). I’d recommend bridging there via Hop Exchange which may be doing an airdrop in the near future.

The fees currently range from sub 10 cents to $10-$15. This is far too high for the average retail participant. It’s important to note that these Layer 2’s actually get cheaper with more network adoption.

Optimistic roll ups get cheaper in a linear fashion with volume. ZK Roll Ups get exponentially cheaper with an increase in volume because of the way it’s batching data back to the original chain.

It will cost the same amount to batch 100 transactions on a ZK as it would to batch 10,000 transactions, thus getting exponentially cheaper as network adoption grows. To further understand the technical specifications of the different styles of roll ups, check out this video from Finematics, someone I’d highly suggest everyone subscribe to.

The current lack of adoption

Ethereum clearly has some scalability flaws. In the case of L2s, there is a lack of infrastructure in place at the moment.

To my knowledge, Binance is the only one supporting Arbitrum withdrawals. I recently discovered a project called LayerSwap which allows you to do withdrawals from most top Centralized Exchanges to the various L2s (Optimism, Arbitrum, ZK Sync, and Boba).

Getting this sort of infrastructure in place and well known by the public will be critical for adoption (I mentioned the correlation of Coinbase withdrawals and network adoption earlier). I call this chart, Pain (as an ETH appreciator).

This chart is the number of transactions on the two networks throughout this year.

The reason for this is a combination of:

Lack of good infrastructure

Different solutions fighting for market share

No Money Markets (Aave and the like)

It’s worth noting how different L2’s fragment liquidity, an obvious issue when contemplating the success of them long term. It’s a very real concern, but ultimately users go where:

Capital is being deployed

There are things to do

So we could see a scenario where it plays out like the current L1 musical chairs where we just bounce around from chain to chain.

Modular vs Monolithic Chains, and current speculation

If you haven’t started learning about Modular blockchains, I’d suggest you get started. This topic should become more and more of a talking point coming into 2022.

Of course we know about the blockchain trilemma, and that ultimately the main large layer ones sacrifice one of the three.

With Modular chains, we are no longer subject to fitting everything in on the base layer. We can now use specific layer twos to perform more specific tasks.

Let’s further elaborate on this using Polygon as an example. Polygon basically functions as an Ethereum scaling “swiss army knife”.

Polygon has several projects with huge upside

Nightfall = Privacy chain (important for enterprises, Sandeep mentioned)

Hermez = ZK Snark payment network

Miden = Starkware

Polygon POS = Their Sidechain (effectively their L1)

As you can see, this is what I meant by “specified layer twos for specific tasks”. @Epolynya has done a fantastic job on covering the various pieces above. He has solidified himself in the Ethereum community as one of the best minds and advocates for Modular chains.

Layer twos, and more specifically, ZK Rollups were starting to gain a narrative prior to the November / early December market correction. It seems to have faded some, but we know Crypto Twitter has a short attention span.

Plays like $DUSK and $MATIC have been performing quite strong through the month of December, only further cementing the layer two narrative. Matic is currently looking well poised for a big year, with protocols like Uniswap passing a governance proposal to migrate over to Matic with nearly a 100% yes vote.

Near is another example of a network using sharded L2s, and they are also already up and fully functional. Aurora is their EVM layer two, you can read more about Aurora here.

I’ll end by saying this, a lot of brilliant minds in the space are:

Big advocates for the layer twos and a modular architecture

Believe ZK Rollups are the “end game” for ETH and ultimately blockchain scaling.

Conclusion:

Being a 2021 crypto market participant has been quite the perplexing year. Between meme coins, metaverse plays, infinite L1s, the DeFi 1.0 bear market, the rise of DeFi 2.0, and all the different twitter narratives, it’s incredibly overwhelming to try and keep track and follow it all.

My suggestions to you the reader:

Focus up and concentrate on specific things. Learn ecosystems in and out, play with all the different dapps.

Strong L1s should continue to perform well and grow their ecosystems. If you don’t like those options, you can try to be early and farm on chains you think have potential to be the next major capital rotation. Most importantly, follow capital flows, and don’t fade narratives. If 2021 has taught me one thing it’s this.

Thank you for taking the time to read through our top takeaways and thesis for 2021. To keep up to date with future posts, check out our Twitter @mafia_defi, and make sure to subscribe to the Substack!